Forecasts Insure Against Bad Weather

Interview with

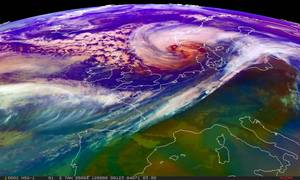

Dave - Now moving away from clouds and over to the extremes of weather, more specifically windstorms. For example, the winter storm Anatol blew through Europe, including the UK, Sweden and Germany, and caused economic damages and approximately 2.9 billion Euros. Much of this was claimed on insurance. And so, insurance companies are very interested in predicting these extreme weather events. A team from the University College London's Climate Extremes group have created just the tool to do this and formed the company Eurotempest to help European insurers to help prepare for the billions of pounds weather damage that may be coming their way.

Meera Senthilingam went to visit them in London and met Operations Director, Frank Roberts to find out what they need to know for these predictions and how these weather forecasting data is collected in the first place.

Frank - Well in the first instance, the modelling agencies - that's the national meteorological agencies of any country and in the UK, that's the UK Met office - will collate observations from all over the world. I think the Met office collect about half a million per day at the moment and that can be from any source. So satellites, weather balloons, surface observation stations, buoys at sea, aircraft. From that, they need to build a complete picture of the atmosphere because obviously, these observations were only taken at certain points, and this is what they called the assimilation process. They have complex mathematical models to do this. And from that, they will then use what they call their numerical weather prediction system. The atmosphere is broken into - on the surface- latitude longitude grid squares, so just like you're looking at a map, and various levels, so you have these cubes of atmosphere. You apply then the physical equations to each cube of the atmosphere in order to be able to predict the various parameters that you're interested in.

Frank - Well in the first instance, the modelling agencies - that's the national meteorological agencies of any country and in the UK, that's the UK Met office - will collate observations from all over the world. I think the Met office collect about half a million per day at the moment and that can be from any source. So satellites, weather balloons, surface observation stations, buoys at sea, aircraft. From that, they need to build a complete picture of the atmosphere because obviously, these observations were only taken at certain points, and this is what they called the assimilation process. They have complex mathematical models to do this. And from that, they will then use what they call their numerical weather prediction system. The atmosphere is broken into - on the surface- latitude longitude grid squares, so just like you're looking at a map, and various levels, so you have these cubes of atmosphere. You apply then the physical equations to each cube of the atmosphere in order to be able to predict the various parameters that you're interested in.

Meera - So parameters such as?

Frank - Temperature, wind speed, wind direction, humidity, the amount of rainfall that you might expect, cloud cover...

Meera - To what resolution is it usually possible to predict the weather? Say, to what area?

Frank - Well the current global model that the UK Met office use is on the resolution of about 60 kilometres.

Meera - Here at Eurotempest though, you focus on the parameter of wind speed and essentially then try to predict windstorms across Europe?

Frank - Yes, that's right. We focus on wind specifically because we provide a summary of information, not for the general public but to the insurance industry. Severe wind causes, over the long term average, about 80% of the insurance loss from natural hazards in Europe.

Meera - So how do you go about collecting data for wind speed and therefore, what kind of information are you putting together to help insurers plan for windstorms that may be coming up?

Frank - Okay, well we take the surface level output from the UK Met office numerical weather prediction model for wind speed and from that, build up a picture of the wind speed forecast for the country in the coming five days, we go out to five days. Also, our customers who are insurance companies have provided us with information about where their insured properties are. So, by postcode, we have information about what we would call their exposure. That's the total value of the insured properties in those locations. And then we use what we call a vulnerability model. This is built up from historical observations of claims and wind speeds in given locations and it's a statistical model which allows us to estimate the proportion of buildings which will be damaged in a given postcode area from a given wind speed. So, you can't say necessarily, of course, that this particular building is going to be damaged, but if you've got enough buildings of a certain type in a large enough area, then you can say what proportion of damage is going to occur. We can do that for a country as a whole for each of our customers and then they have a good idea of what the ultimate payout is going to be from a severe wind forecast.

Meera - What kind of wind speeds does it take to really damage property?

Frank - Well typically, the serious damage really only begins at about 60 miles per hour and that's not particularly usual. It's not an everyday occurrence in the UK. Insurance companies tend to get interested at around about 40 miles per hour, and you can get small levels of damage at those sorts of wind speeds as you might expect - a few tiles or the odd branch breaking a window, or something like that.

Meera - Now, in terms of actual damages and costs, how much damage can be done by wind?

Frank - Well in the UK, on average, it's about half a billion pounds a year which is obviously an awful lot. You might remember fairly recently, just at the beginning of the month, there was this severe windstorm in France, called wind storm Cynthia. Now the estimates for their losses from that are well over a billion pounds.

Meera - So, as well as helping insurers prepare essentially for maybe a large amount of payouts that are about to come out, how else does this benefit them?

Frank - They can prepare for the large amounts of payouts but of course, if there's a severe event, there is likely to be an awful lot of claims coming in all at once. So that helps them to manage their human resources to make sure that they've got enough people in their call centres to be able to answer the phone, to answer the claim from each of their customers. It's obviously extremely important to them that they're able to settle claims very quickly from a customer satisfaction point of view, but also from the point of view that the longer the damage is left unfixed, the higher the bill tends to be ultimately.

We also provide a system for insurers which allows them by postcode and date to interrogate the observation data set. So, when a claim comes in, they will be able to look at their system and they'll see the distribution of observation stations around the postcode, and it will report the wind speed or the rainfall, whatever it might be, so they can check back to see that there were damaging conditions prevailing on the day that the damage happened and then they can validate the fact that the damage that's been reported by the insured is actually consistent with storm damage.

Meera - But now, what makes this vulnerability model better than insurers just keeping an eye on weather forecasts?

Frank - Well the public and media weather forecasts are specifically designed for public consumption and for public safety, and that will be couched, often, in terms of "we may see 80 miles an hour gusts at peak". It doesn't really say in any great detail where exactly that might be expected. And that's a sort of high resolution information you need to predict for an insurer. So, translating a verbal media forecast into a forecast of loss is actually very difficult for anybody to do and in the past, we've had examples from customers who said that had they only had the media forecast available and tried to interpret that in terms of what their exposure was, they would've been out by a factor of 10, compared to what we were correctly saying.

Dave - With all that saving, hopefully, our insurance payments will be more efficient in the future and hopefully a bit cheaper. We'll have to keep our fingers crossed on that one.

Ben - Indeed, we will. Yes, that was Frank Roberts, Operations Director at Eurotempest talking to Meera Senthilingam.

- Previous Steampunk

- Next Steering Hurricanes Out of Harm's Way

Comments

Add a comment